Fraud

Contact Us

Reduce the Risk of Fraud

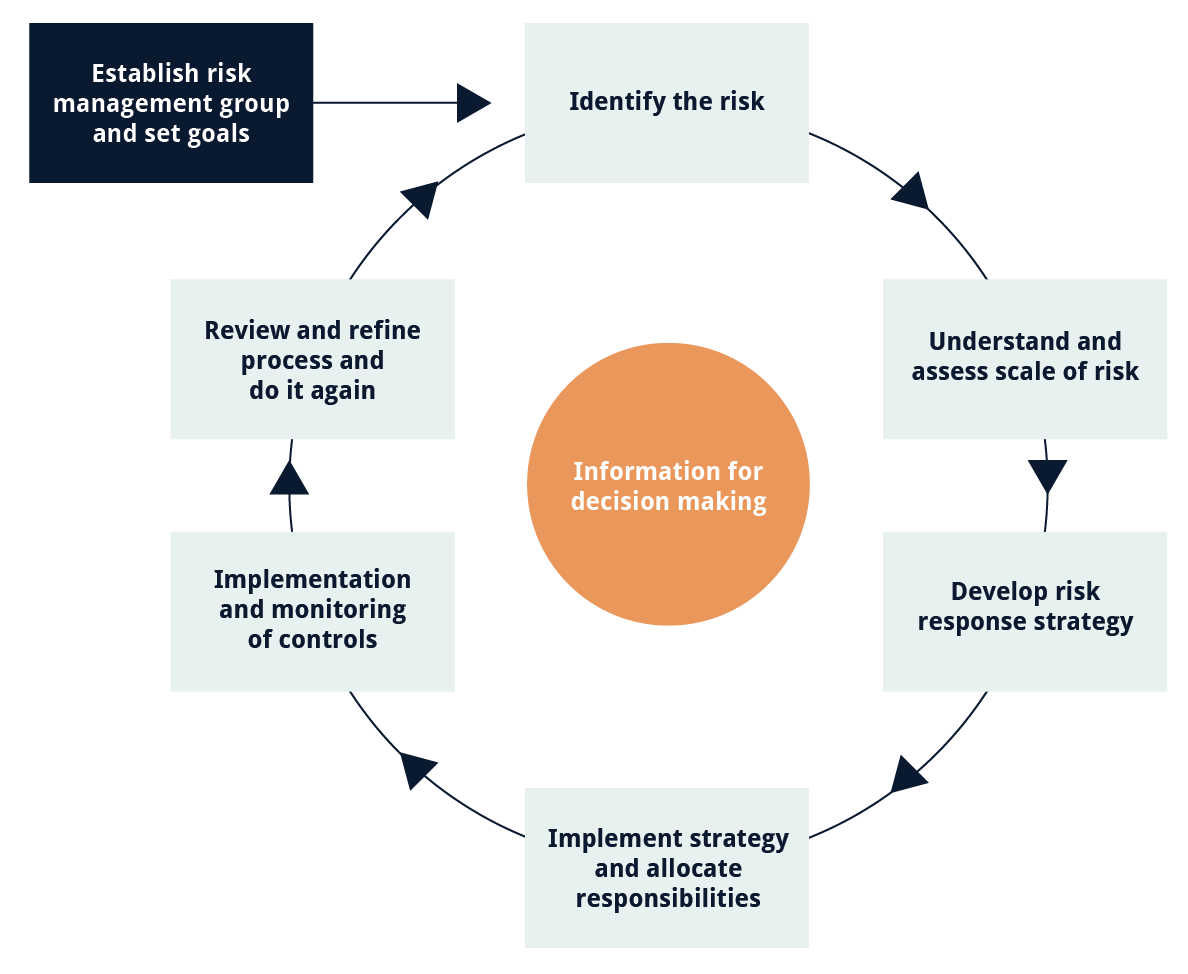

The Risk Dashboard can assist you in creating an effective fraud risk management framework which will enable your organisation to implement controls that help prevent fraud from occurring and formulating a response plan for any possible incidents.

“The Risk Dashboard: Diagnose, Detect and Respond” will help you to analyse:

Diagnose vulnerability to Fraud

Recommend mitigating anti-fraud controls

Develop a fraud response plan

Detect gaps in anti-fraud controls

Continuous or periodic monitoring

Investigate cases of alleged fraud

Examples of common types of internal business fraud can include:

Asset Misappropriation

Theft of cash, taking cash before recording revenues, or stealing incoming funds through a fake account

False Payment Requests

False payment instructions, or a false email payment request with forged signatures

Cheque Fraud

Theft of, duplicating of, or tampering with company cheques, or depositing a cheque into a third party account without authority

Billing Schemes

Over-billing, recording false credits, ‘pay and return’ schemes, and false billing details

Misuse of Accounts

Wire transfer fraud, unrecorded sales, employee account fraud, false credit notes, or stealing passwords

Inventory and Fixed Assets

Inventory theft, false write offs and sales, theft of assets and confidential information, etc

Procurement

Altering purchase orders, falsifying documents, forging signatures, false invoices, changes to payment terms etc

Payroll

Fictitious employees, falsified work hours, abuse of commission schemes, improper salary level changes, etc

The heart of Fraud prevention practice sits within the Risk Dashboard software.